Michael Lewis, Claim Technology founder: “Based on Corezoid we are building AWS for B2B financial services companies”

|

|---|

| Michael Lewis, Claim Technology co-founder |

– Tell us the story behind Claim Technology. When was the company founded? Why did you decide to found the company?

– Claim Technology was founded in 2017 by myself (15 years experience at Goldman Sachs, IBM and at C-Suite in BPO companies) and Jonty Hurwitz, who co-founded Wonga. Our aim was to bring the same level of disruption into the insurance claims process that Wonga had brought to consumer lending.

At the time, the insurance industry spent $130bn per year on manually processing claims - a clear indicator that the $5bn spent on vendors such as Guidewire (whose tech stack was designed for a manual, product-centric model) wasn't working. Our initial goal was to create the industry's first cloud-native tech stack designed for an entirely touchless, customer-centric experience.

Think of Claim Technology now as a Business Process-as-a-Service (BPaaS) platform for financial services.

Whilst Corezoid enables companies to design processes in the cloud, our platform provides:

- the front-end applications you need on top of Corezoid for customer self-serve or employee enablement;

- an eco-system of integrations into 3rd party vendors that can be embedded inside processes without the need to build and maintain direct integrations.

This enables financial services companies to focus on achieving process ‘outcomes’ without worrying about all the apps and integrations needed to implement the process.

– What did the early days of the company look like? How big was the team? How did you persuade the first people to join the company?

– We took the most complex, manual claims process we could think of (Personal Injury) and spent our seed money showing how we could do what everyone said was impossible - to automate the claims process from start to finish.

That enabled us to raise $2m to grow a team of 12 people. At the time, I was on a flight when the person next to me (a final year student) initiated a conversation mid-way through the flight. I was so impressed that when I landed in London I committed to launching a 2-week summer scheme for under-graduates (absolute madness for a new start-up). One of those under-grads now leads our product development team.

|

|---|

| Ashley Preece, Implementation consultant at Claim Technology, graduate of the Claim Technology internship scheme |

– Describe the insurance market in general? Who are the main players? What are the main specialisations that companies have? What is your niche?

– For hundreds of years, insurers have defined themselves as loss-reimbursement businesses. The customer pays a premium up-front and if they suffer a loss, the insurer will reimburse them.

Technology has the opportunity to turn the model upside-down and create win/win models where insurance becomes a loss-prevention business (using sensors, IoT, real-time warnings of say a weather event) and where claims, if they happen at all, are paid instantly by new parametric-designed products.

I see a future where insurance flows as significantly and as invisibly as the everyday transfer of money.

– What were your initial goals, market objectives, KPIs that you were aiming to achieve?

– The initial goal was to show how it was possible to introduce a platform (like Uber) into the insurance market with the infrastructure and tools to automate processes in the cloud. This new way of developing IT solutions would create a 'win-win-win' model for insurers, their supply chain and customers, reducing the cost of insurance for customers, whilst improving insurer and supply chain margins at the same time.

– What did the IT-landscape of the company look like when you started Claim Technology? What worked well? Which pieces of software did you feel were missing or not working well?

– From a consumer perspective, we said chatbots (an important component of our customer experience) would be the new mobile apps. No one believed us and it was easy to understand why - the market was so immature and these bots learned at the customer's expense. But we showed the market an alternative.

Our conversational UI was designed to deliver a better experience than the best human-led alternative at the time, reducing operating costs by 95% and cycle times by 65%.

– How did you discover the Corezoid technology? What attracted your attention to Corezoid? What was your first experience of using Corezoid?

– I've had an academic interest in BPM for 20 years. I followed the evolution of the BPM market and the development of the BPMN 2.0 standard (which I taught).

When I came across Corezoid it was a eureka-like moment - I knew that this was a low-code toolkit that would enable any thinker inside an organisation to become a maker of highly automated, scalable processes in the cloud, a perfect complement to our vision for the industry.

– What role do you see for Corezoid technology in Claim Technology's growth strategy?

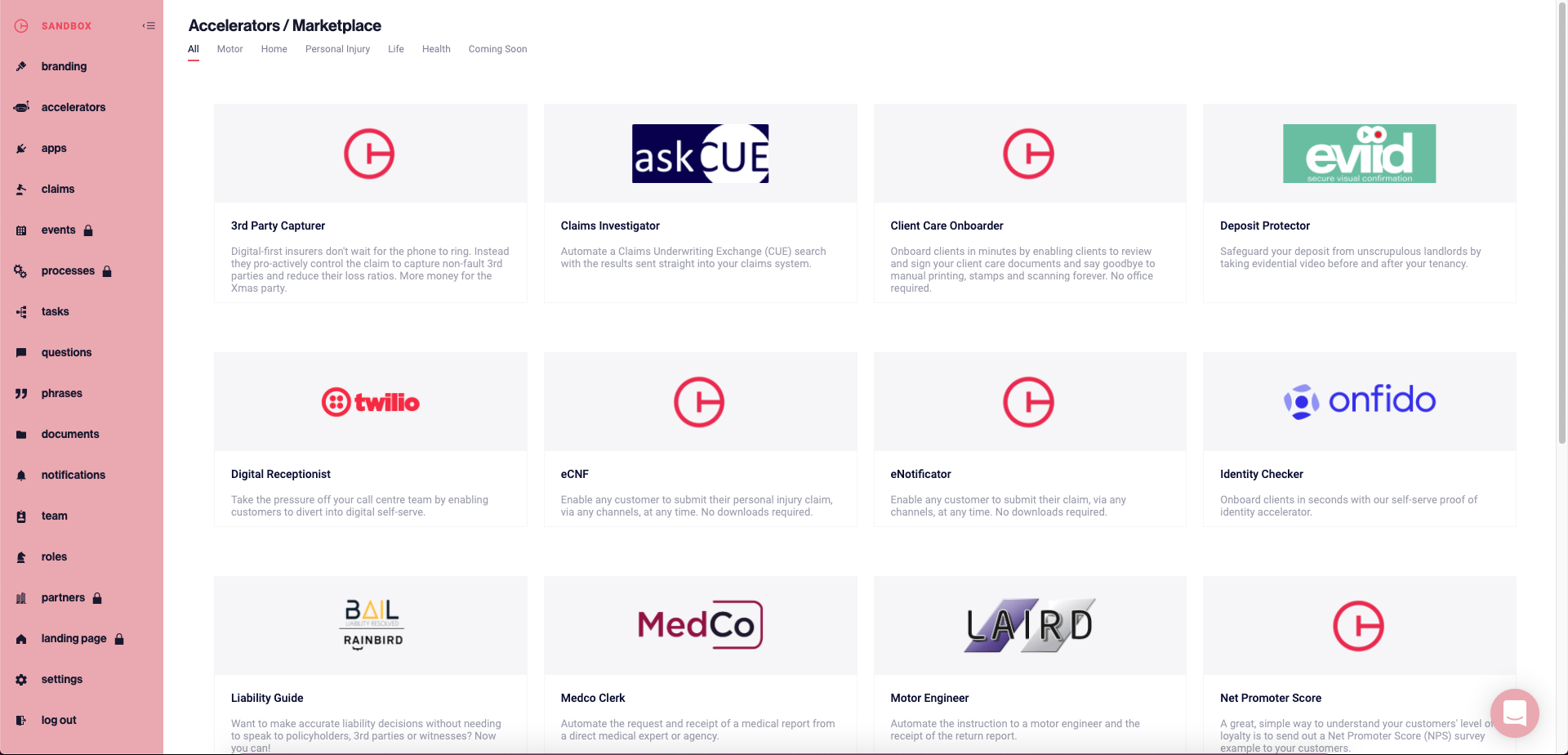

– Our recent 1-Click Marketplace launch enables anyone in the industry to both contribute to, and consume, plug & play enterprise business process solutions with just 1-Click. It's like AWS but for B2B financial services companies. These services are orchestrated by Corezoid.

– What are your plans and ambitions for the next months\years? How the market will change? How did COVID-19 affect the market?

– Covid 19 has accelerated the belief that large enterprises can make change happen faster than they thought possible. Having seen how easy it is to implement digital tools like Zoom, now is the time for Operational teams to move to the next level and say; what's stopping us from just as easily creating new business models and automating business processes in the cloud?

For IT teams, the challenge will be to re-imagine their role. In the same way that the hardware layer (servers, routers etc) has moved from on-premise to AWS/Azure, the same logic applies to the business process layer; business process platforms like Claim Technology mean that IT teams no longer have to design or build processes in-house (including 3rd party integrations) - as a cloud platform is fundamentally faster cheaper and more robust than in-house efforts.

Instead, the focus for Enterprise IT should be on integrating the best ideas and solutions 'from outside of the company' into the company's capability stack and up-skilling IT staff on how they leverage their data to create lasting competitive advantage for their CEOs.

– Could you, please, speak a little bit about the culture of the Claim Technology company? Which things do you value in employees? How do you attract the best talents to work for Claim Technology?

We've been a virtual company from the start, so very unusually we have no employees, no offices, full transparency on pay, unlimited holiday allowance and an ongoing experiment with zero hierarchy to name just a few policies.

We're a team of exceptionally creative individuals who love the industry we serve and who want to work collaboratively with others to build the future of insurance.

We've been industry awards finalists 11 times in the last 2 years, including the winner of the Technology Innovation of the Year award. If this has piqued your interest, drop me a line.

– What do you do to keep yourself fit? Do you like sports? Could you, please, share with us any of your lifehacks\secrets of productivity?

– I recently subscribed to Buzzbike - a subscription service that enables me to rent a bike for just £1 per day. The bike comes with insurance and maintenance included in the price. I am loving getting to know London from a different perspective - and how cycle quietways and superhighways are making a difference to both my personal health and public transportation.

|

|---|

| Buzzbike in London |

– Could you, please, recommend to our readers some books\movies, that have struck your attention recently?

I am a keen reader - two books I recently read and would recommend for any would-be entrepreneur are 'The Platform Revolution - How Network Markets are Changing the Economy' and 'Zero to One'.

|

|---|

| “Platform Revolution: How Networked Markets Are Transforming the Economy-And How to Make Them Work for You” by Geoffrey G. Parker. |

|

|---|

| “Zero to One” by Peter Thiel. |

– Could you, please describe exactly, how your platform works?

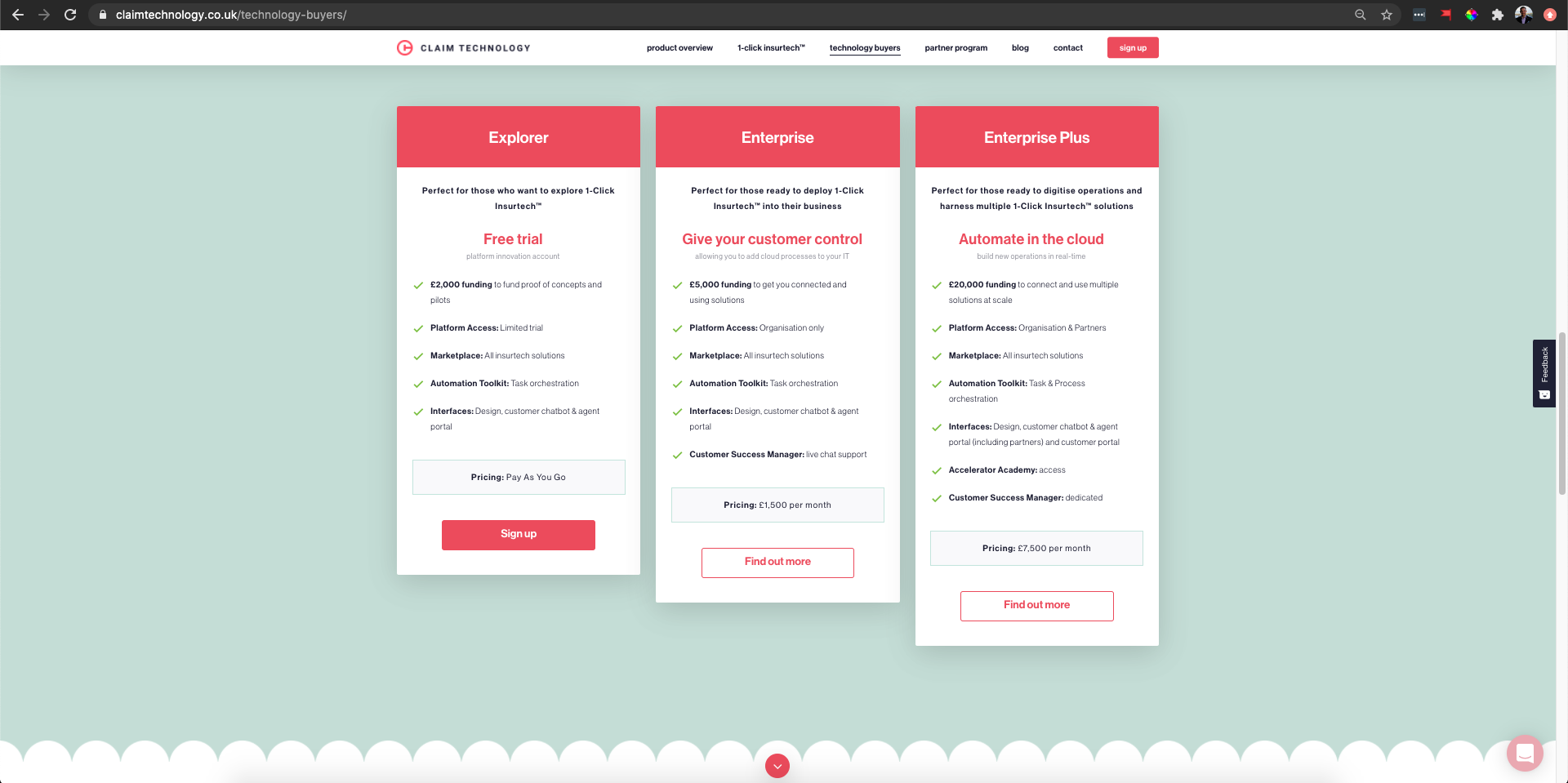

– Simple. Sign-up for a free trial account and take any of the 1-Click accelerators for a test-drive. If you need to customise the accelerator or don’t see what you’re looking for, let us know. Our Innovation Funding program provides funding for us to do a deep-dive on the problem you’re trying to solve, and you can nominate 3rd party solution partners you want to connect to via the platform without the need to build an integration with them directly.

|

|---|

– Could you describe a real example, please?

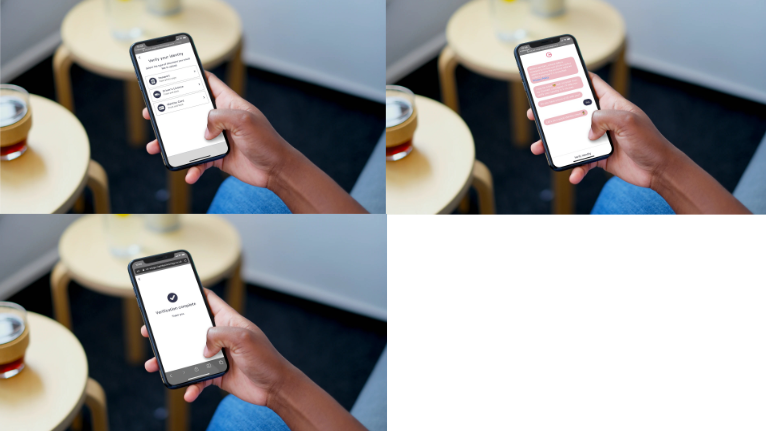

– Let’s take identity verification. This is a very common use case in the banking sector when onboarding new customers. By manually entering a mobile phone number (or making a single API call from the bank’s system), our platform will automate the process of sending an SMS to the customer with a link for them to take a photo of their identity document and utility bill.

This service combines our platform’s customer self-serve web app with in-built integration for Onfido’s enterprise-grade verification software. The client can complete the process in seconds. The bank benefits by being able to use a GDPR compliant solution where a mobile app isn’t required or possible and which can be extended/customised for different lines of business in minutes (to include data capture, document generation, client signature, payment etc) without a single line of code.

|

|---|

– What is the role of Corezoid Hyperautomation Engine here?

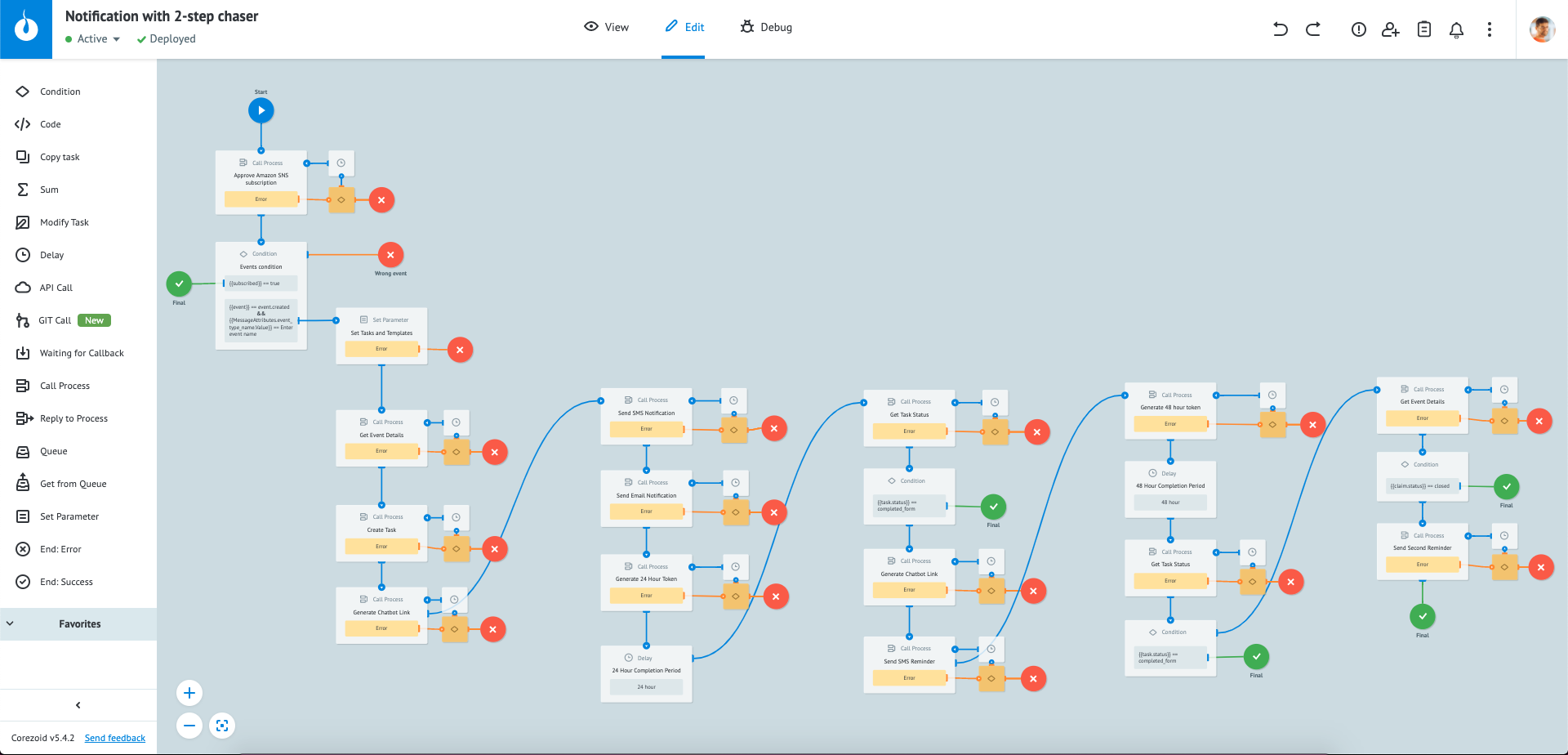

– Let’s look behind the scene. Corezoid provides the underlying process orchestration so it detects that an ‘event’ has occurred (i.e the process has been triggered by an employee, by the customer, by an API call or the completion of another process). Once detected, the process has started. Corezoid will then run some conditions, fetch the customer data, generate the URL to insert into a text message, send the text message, monitor whether the customer has completed the process, send a reminder text message at the appropriate time, and either end when the customer completes the task or send an exception task to a voice bot (e.g Voca.ai) who calls the client via the phone to check whether they received the message.

Corezoid coordinates the process, where we determine what process steps need to happen and how exceptions need to be handled when something goes wrong (e.g integrated SMS service isn’t available), or the expected result doesn’t occur (e.g the customer didn’t successfully self serve). The entire process is running automatically in the cloud combining BPM, AI, RPA with zero human touch on the part of the fintech, unless of course, an employee needs to be brought into-the-loop.

|

|---|

| Example of business process automated with Corezoid |

– What is the best way to start working with Claim Technology?

– Sign up for our Explorer program from www.claimtechnology.com. This not only provides you with a free trial platform account but also comes with $3,000 of platform credits to help you innovate faster.

|

|---|

| Claim Technology |